Suburban Housing and Detached Properties Fuel Growth in Power of Sales

Signs of financial pressure are becoming more visible in the GTA housing market. A growing number of Power of Sale (POS) listings is revealing exactly where these challenges are being felt the most.

Mortgage arrears are rising — sitting above 0.4% at several major banks and reaching as high as 6% with some private lenders. These arrears are now showing up in the resale market, where more properties are being forced onto MLS as Power of Sale listings.

This is happening at a time when overall inventory is already at elevated levels, while buyer demand continues to lag.

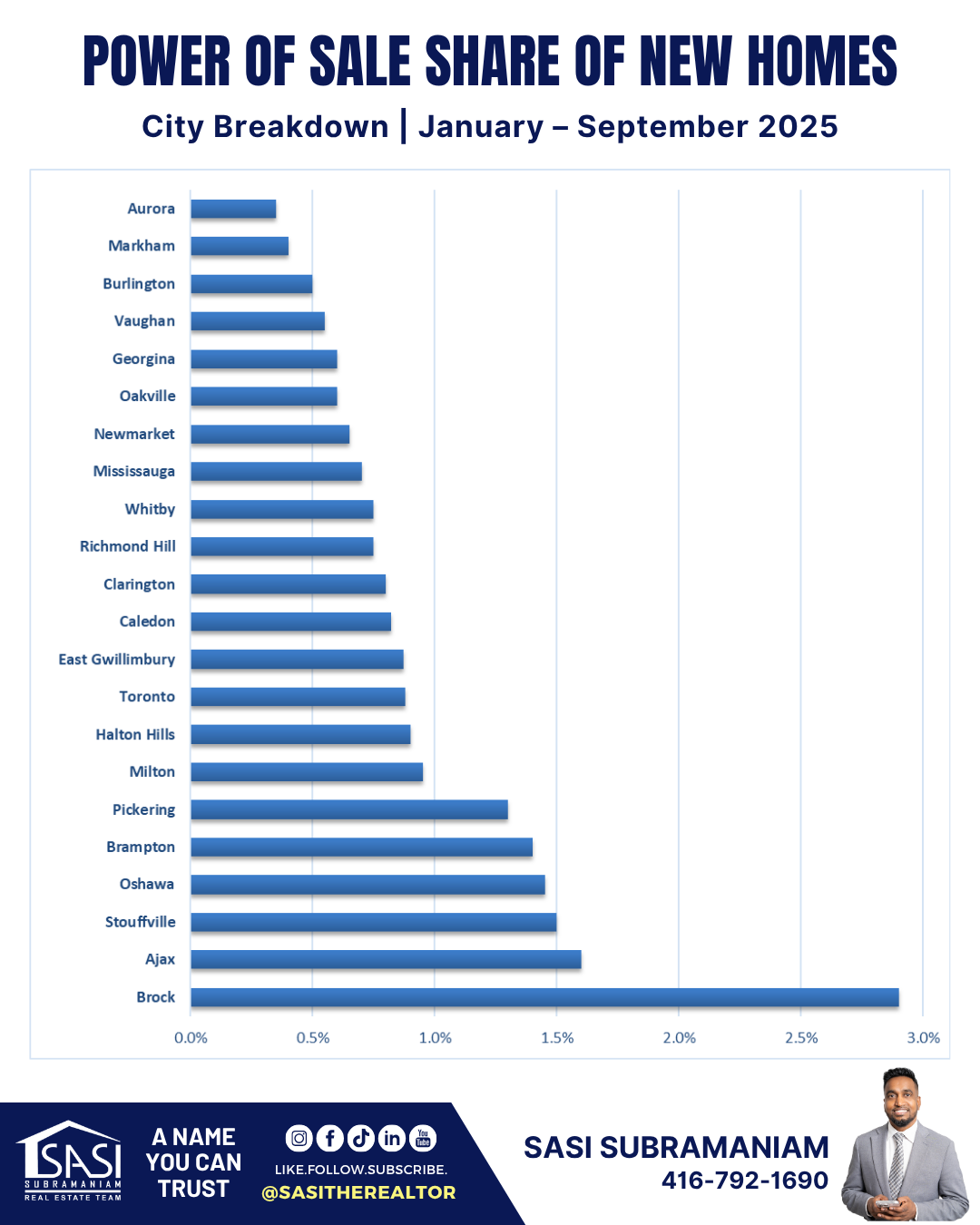

Looking at the geography, the highest shares of POS activity are concentrated in suburbs and outer-GTA communities that saw the biggest surge in prices during the pandemic migration out of Toronto. Brock, Ajax, Stouffville, Oshawa, and Brampton are among the municipalities most affected this year.

In some of these areas, financial strain is now translating into price declines. Brock has seen average home prices fall 15% year-over-year, while Stouffville is down 13% — two of the steepest drops in the region.

Meanwhile, established suburbs such as Aurora, Markham, and Vaughan are showing much lower rates of POS listings. This highlights how uneven the stress is across the GTA — some markets are under far more pressure than others.

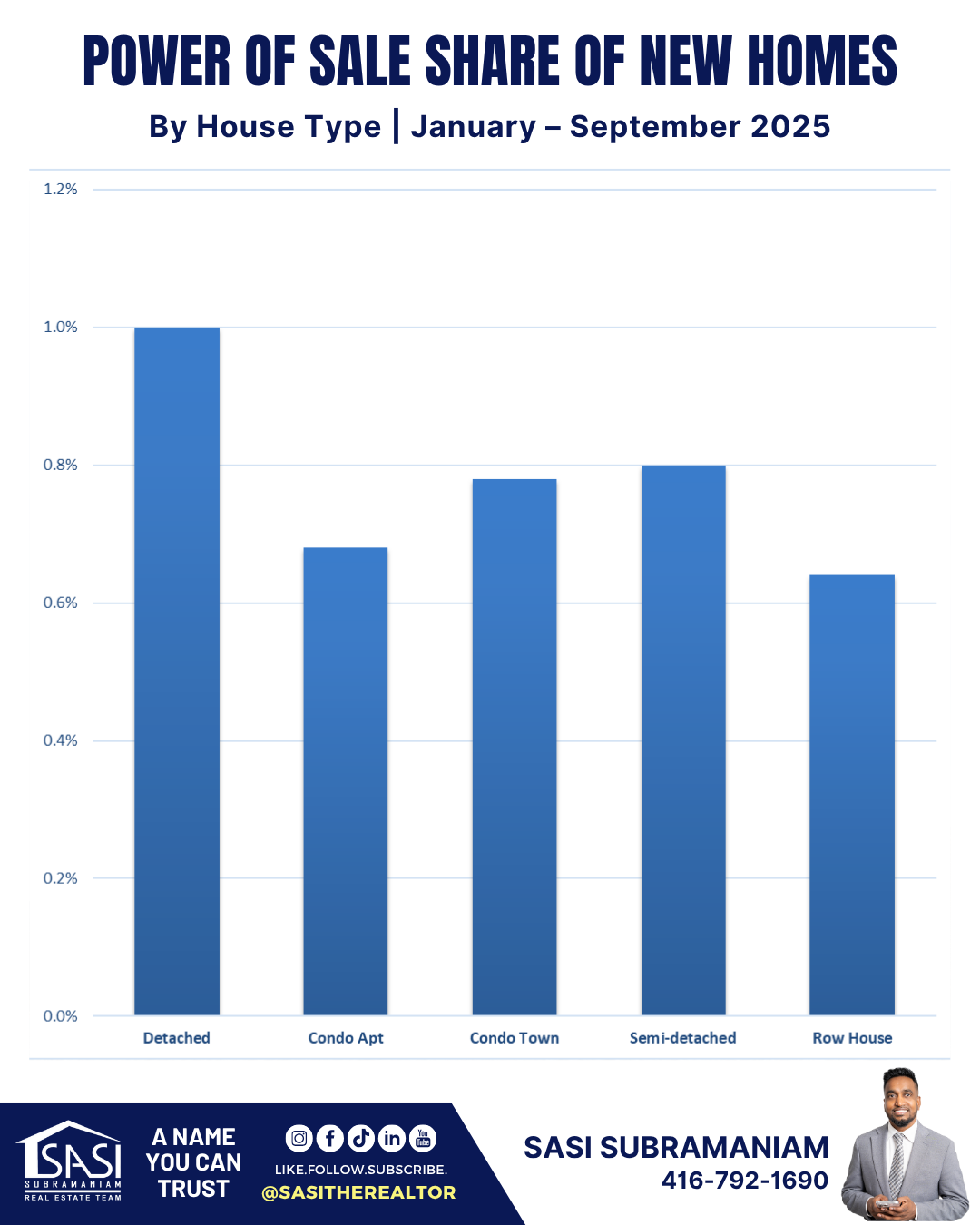

Detached houses are driving this trend. Roughly 1% of new detached listings this year have been Power of Sale, compared to 0.66% for condos. Detached owners often carry larger mortgages, many of which were taken out during the low-interest pandemic boom. Now, as those loans reset at higher rates, some owners are finding it difficult to keep pace.

At the neighbourhood level, a few areas stand out. Four GTA neighbourhoods have Power of Sale shares above 4%, with Highland Creek in Toronto topping the list at nearly 10%.

Although POS listings are still a small slice of the overall housing market, they’re a key signal of financial distress. As more of these properties hit MLS, they could add to already-high supply in certain communities. If demand doesn’t strengthen, this could lead to further downward pressure on prices heading into the winter months.

This analysis is based on MLS data for new listings in 2025 where the seller is identified as a bank, trust company, or explicitly listed as a "Power of Sale."

Categories

GET MORE INFORMATION